By

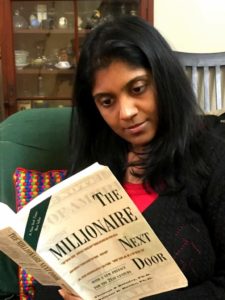

Khushali Gandhi Shah

Psychologist | Behavioral Trainer | Developing Human Capital

There is no specific visual description of a millionaire. Instead, most people who are wealth creators and millionaires don’t look the wealthy, spendthrift, extravagant people enjoying many luxuries. Millionaires think differently from what the general public assumes.

Mindset of a Millionaire

Millionaires think differently from others. They are truly independent in their thought process.

They don’t let the usual public opinion and way of living influence or define their way of living.

There is no such thing as living, acting, or being like a millionaire. That most people who live in expensive homes and drive luxury cars do not actually have much wealth.

A large majority of millionaires become so out of the sole interest in being financially independent. They live below their means and frugality is second nature. The actual meaning of being financially independent is when you can maintain your current lifestyle for years without earning even one month’s pay. Some of the factors I found really interesting and useful are:

1. Living below your means. It doesn’t matter what your means are. Having the mindset to plan and making that conscious choice each day matters. Reducing credit usage, keeping in mind health, unforeseen circumstances, and keeping your liabilities as low as possible goes a long way in building wealth.

2. Allocating time, energy, and money efficiently in a way that helps building wealth – creating habits and ways of living that contribute consistently to building wealth. The belief that financial independence is more important than displaying high social status.

3. Most millionaires are first generation.

Habits of a Millionaire

4. It requires both spouses to be emotionally, financially and behaviorally on the same page. In the long run you as a family cant get wealthy if one of your family members is a hyper-consumer.

5. Frugal frugal frugal all the way. Being frugal is not the same as being a miser. A frugal person is conscious in spending towards his needs while assessing its usefulness without the social pressures.

6. The perfect way to build habits of wealth accumulation is defense, and this defense is anchored by budgeting and planning. Millionaires become who they are by budgeting and controlling expenses, and they maintain their affluent status the same way. Some of these habits include; operating household on a budget, with savings planned; knowing where we spend each year for food, clothing and shelter; and spend time planning financial future with specific goals.

7. Financial advisers are not the best resource for building wealth accumulating habits. They have a rather narrow focus since they sell investments and investment advice. They do not teach thrift, budgeting and building the right kind of relationship with money.

Lifestyle of a Millionaire

Knowing it and living it year on year are different things and forming those habits really help in altering your lifestyle effectively. Among other things, I learned that many people who have a great deal of wealth do not even live in upscale neighborhoods. It helps their lifestyle stay

meaningfully below their means, and saves them from having to maintain the environment. For example, living in an upscale neighborhood comes with exclusively done up house, more and

expensive domestic help of all sorts, having better cars, socializing with gifts and other aspects, kids’ tuition and maintaining their corresponding lifestyle too.

8. Wealth is not the same as income. If you make good income each year and spend it, you are not getting wealthier. you are just living high. Wealth is more often the result of a lifestyle of hard work, perseverance, planning and most of all self discipline.

9. Fewer than one in ten millionaires are ‘active investors’. Active investors are those who sell their stocks within a year. So most millionaires are long term investors.

10. Millionaires hire their financial adviser after a lot of scrutiny. It is not the usual bank adviser or self claimed financial adviser. People who work towards building wealth practice it themselves and mostly the adviser is just for advice.

11. Wealth accumulators and millionaires do not believe in spending on depreciating assets such as cars and an over expensive house to live in. They realize the amount of liability it can create while maintaining it.

12. Receiving financial and economic care from parents and other family members can prove to be harmful, unless you learn to truly save and invest all of that. Gift receivers frequently are underachievers in generating income. All too often the income of the gift receiver does not

increase at the same rate as their consumption.

13. For all those who would like to raise their children with financial integrity, this book is a must with a bonus of final chapter on a wealth building family style.

The only reason I got my hands on this treasure is Women on Wealth. A community of real women wealth creators!

What’s your take on this book? Leave a comment if you’ve read it, or if you know other hallmarks of millionaires!