There’s been a lot of buzz lately about how Indians can now invest in global companies.

This means that you can start buying shares of companies like Google, Apple, Tesla, and other strong brands from different parts of the world.

It’s an exciting new era for Indian women investors. Let’s look at what it means to invest globally. Learn about some of the key factors you should know about and how you can invest in foreign companies as a citizen of India.

Create geographical diversification

Why would you look at investing in companies outside of India?

One strong reason is that you can diversify your portfolio. As many investors know, it’s important not to put all your eggs into one basket. Spreading out your investments in gold, debt funds, equity mutual funds, shares, and other instruments helps you manage your risks.

With global investing, geographical diversification comes into the mix. You can benefit from the differences in market performances in different countries and regions.

Benefit from other countries’ strengths

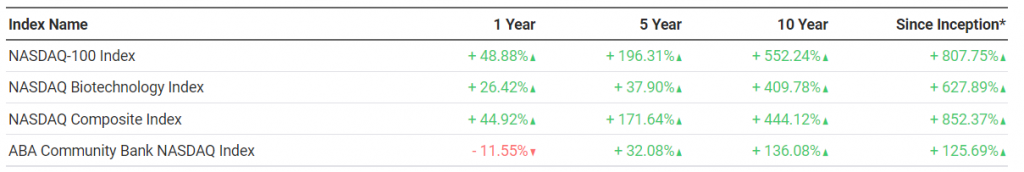

If we look at the performance of the IT sector in the US and India, we can see stark differences. In the past year, Nasdaq’s composite, which is the index of IT firms in the US, did not do as well as India’s NIFTY IT.

But if you look at long-term performance, Nasdaq IT gave much higher returns.

In the above table, NASDAQ Composite Index returns pale in comparison to NIFTY IT’s returns. But when we look at longer returns NASDAQ clearly gives better returns.

There is a world of difference in how much your money would grow if you were invested in NASDAQ vs NIFTYIT.

It’s no surprise that the US market’s IT sector gives such a strong performance. The country’s focus on innovation and technology is highly funded and ambitious.

It makes sense to find industries and sectors that are especially strong in other countries and to invest in them.

Watch out for the security of your investments

It sounds exciting to invest abroad. But should you dive into it without doing your research? Of course not.

Aside from looking at returns and performance, you also have to consider the safety of your investments. How strong are the regulations of the foreign country? Is there high currency fluctuation? Is the market volatile due to political upheavals?

Some thoughts:

- Companies like the US have high regulation of the markets and investing in US companies is relatively secure

- Be wary of countries that don’t share enough information. Countries like China are riskier to invest in due to communication issues and governmental interference

- According to some investors, countries like Russia where there is high governmental intervention and currency fluctuations should also be avoided

Be wary of the location you choose to invest in. As appealing as an industry or a country seems, it’s not enough.

You need to look at the legal recourse available to you in case there are issues like fraud or if the market goes against you.

How to invest in global companies

Investing in companies outside India is becoming easier every day. There are many platforms and different instruments that you can use. Here are some practical ways you can invest in global companies

Mutual funds

Did you know that there are many Indian mutual fund schemes that have global companies in their portfolio?

If you do a quick Google search for ‘International Mutual Funds’, you’ll find several schemes that invest in companies abroad. These mutual fund schemes typically invest in the top tech companies of USA. And you can get a slice of these by investing in such mutual funds.

However, never blindly pick a mutual fund just because it has an attractive description. There are certain important metrics you should look at.

We help women learn how to study and pick the best mutual funds through our online programmes. However, choosing mutual funds without a goal and without an overall financial plan doesn’t make any sense. If you’re an Indian woman who wants to become financially savvy, please reach out to us.

Also, did you know that the name ‘International’ can be an overstatement when it comes to some mutual fund schemes?

Our programme graduates at WoW, women just like you and me, found that there are international mutual funds where foreign companies are just 5% of the entire portfolio. The rest are from Indian companies. Does that sound like a very international fund to you?

Being part of a community is essential if you want to stay updated with the right information. And one of the key benefits of joining our programmes is being part of a women-only community.

Exchange-Traded Funds

ETFs are an easy way for people to invest in an index. An index is a group of companies that represent the economic strength of a company or a sector.

For example, NIFTY 50 refers to the top 50 countries of India. And together, their movement in the stock market is viewed as a sign of how the economy is doing.

Similarly, NASDAQ is the US’s index for tech stocks. And the S&P 500 (Standard and Poor) refers to the top 500 companies in the US.

You can invest in foreign companies by using ETFs that are focused on foreign indices. You’ll have to sign up with a broker that offers these facilities.

Direct investment in equities

If you’re not interested in mutual funds, then you can opt to invest in equities directly. And here as well, there are two main approaches.

Invest through a broker

To invest in any equities, you have to have a demat account. You can open a demat account with an Indian broker who has a foreign partner.

The advantage is that you’ll get advice from the broker, although a high fee is also part of the arrangement.

Invest on your own

Banks like HDFC and ICICI enable their customers to invest in foreign countries through their demat accounts.

Reach out to your bank’s customer support and ask them about the international investing options.

In this case, you’ll have to assess and pick stocks on your own. Don’t know how to choose quality stocks? No problem, we’ve been helping women study stocks and make independent decisions on how to choose the best stocks for their long-term goals.

Once you know how to choose the right stocks, you’ll be able to do it manually from your demat account. Each transaction will have a small brokerage fee.

Continue building your financial education

Investing in good-quality companies is a proven way to build wealth and fulfill your dreams. Whether it is to retire in comfort, provide for your children’s education and marriage, or to donate to charity.

If you’d like to see the video version of this blog post, then click on this link to WoW’s Facebook live video on global investing.

We, at Women on Wealth, help women in India from all backgrounds and locations to learn how to become financially literate.

Follow us on social media and get in touch if you want to join our Money Gym program or learn The Art of Picking Quality Stocks.